Fed's rate cut offers relief; challenges remain for industry

main text

Fed's rate cut offers relief; challenges remain for industry

Federal Reserve Board of Directors

Federal Reserve Chairman Jerome Powell discusses the rate decrease during a Sept. 18 news conference.

In case you missed it, a bit of drama preceded the recent Federal Reserve's decision to lower the Fed Funds Rate.

The expectation for a cut in rates at its September meeting was a foregone conclusion, but the size of the cut was rigorously debated in the financial press. The financial markets clearly signaled a desire for a cut of half of a percentage point. The Trump campaign stated a cut of that magnitude would favor the Democrats in upcoming election.

For the record, I expected the Fed to take the conservative route and start this round of easing with a more usual cut of a quarter of a point. I was mildly surprised, and somewhat relieved, by the decision to start with a cut of a half a point. High interest rates have clearly constrained the manufacturing sector and the plastics industry for well over a year now, and there are indications these constraints were getting worse at an accelerating pace.

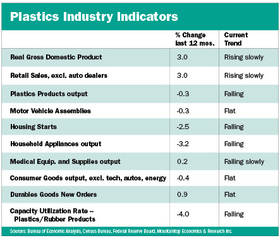

I have put together a table of my favorite plastics industry indicators. In the first column, I have listed the amount of growth in these particular indicators over the past 12 months. The Fed last raised rates at its meeting in late July 2023. So, the peak in interest rates for this cycle has been in place for just over one year. In the second column, I show what the trends in these indicator data have been for the past three to six months.

The changes in some of these indicators are not as good as they might first appear and therefore need some additional explanation. Allow me to add some color.

According to the data, the change in inflation-adjusted gross domestic product over the past year has been a solid 3 percent increase. This is a respectable number on the surface as it is close to the optimal growth rate for the U.S. economy. In other words, 3 percent per year is the best we can do over the long term without causing inflation or market bubbles.

But if you look below the surface, it becomes apparent this growth of 3 percent in the overall economy during the past 12 months was likely the result of a huge infusion of government spending in 2023. This is definitely not sustainable, and in fact, it represents a long-term risk to economic growth in the future. I will have more to say about this in future columns, but for now I am most uncomfortable about the recent direction of the GDP data.

Total retail sales, the second category on my list, also shows a nice 12-month growth rate of 3 percent. This data is not adjusted for inflation, so a growth rate of closer to 5 percent would be ideal in a perfect world, but 3 percent does not seem too bad. Here again, we need to look more closely at the details.

The bulk of the growth in the overall retail sales data is due to gains in online sales, restaurants and big-box stores such as Walmart or Costco. The sales totals for establishments that represent major end markets for some types of plastics products such as building supplies or home furnishings are actually negative. This indicates to me demand in many segments of the plastics industry is not only waning but is getting worse at an accelerating rate.

The remaining categories on my list all tell a similar story. During the past 12 months, the growth rate for the total output of plastics products is flat-to-down, and the capacity utilization rate for the plastics industry is deteriorating. And if you look at the trends for the past three to six months, the downward momentum is picking up speed.

The same can be said about the output levels of most of the major end users of plastics products. The trends are flat-to-down, and the situation is getting worse.

The overarching theme for the plastics industry is the prevailing economic conditions are tough, and they are starting to get even tougher. If one were to look at just the manufacturing and residential construction sectors, there is a compelling argument the Fed is late with its decision to cut rates now.

We know the Fed has two mandates from Congress: price stability and maximum employment. That's the job description, and I have no problem with its desire to stay focused. And I have to say on a macro level it appears it has had an excellent job over the past couple of years. Prices are more stable, and the labor market looks balanced.

However, for some sectors of the economy, the drama is far from over. As of this moment in time, the interest rates are still restrictive and the trajectory in the data for many of the plastics industry indicators is still downward.

I expect it will take at least another quarter or two before we see definitive cyclical bottoms in some of this data. That is especially true for the data series that measures total output of plastics products and the capacity utilization rate for the plastics industry.

In my opinion, the most important indicator to watch will be the trend in housing starts. This is where the biggest imbalance in the economy exists, and — as I have always preached — this sector has the biggest cascade effect on the overall economy. I fully expect lower interest rates to improve the trend in the residential construction sector and ultimately in all of the sectors that are dependent on the trend in this sector.

But I do not expect this trend to improve immediately. With interest rates headed lower, there is an incentive for prospective buyers of new and existing homes to postpone their decision until mortgage rates fall further. There is also a seasonal incentive to postpone a decision because both homebuilding and home selling conditions are not as good in the winter.

Six months from now, the weather will be warming up and interest rates should be more attractive. And if all goes well, the growth rates and trends on my table will look decidedly better.

* Source : https://www.plasticsnews.com/news/feds-rate-cut-offers-relief-challenges-remain-industry

* Edit : HANDLER

- PreviousPlastics industry outlook remains positive despite ‘temporary setbacks' 24.09.21

- NextPolypropylene prices increase in August 24.09.21