EU mulls mandatory recycled content in construction, automotive and pa…

main text

EU mulls mandatory recycled content in construction, automotive and packaging

The European Commission is considering extending mandatory recycled content targets to the construction and automotive sectors as well as the packaging sector, a representative for the EU’s executive body confirmed this week.

“The Commission will come with proposals for mandatory recycled content in the areas of packaging, vehicles, and construction products. This will provide further demand and stimulation for the market of recycled plastics,” said Aurel Ciobanu-Dordea, director general for environment at the Commission.

He was speaking at the ICIS Global Plastics Recycling Policy summit, which runs on 23-25 May.

These measures would be in addition to the Commission’s existing requirements that polyethylene terephthalate (PET) beverage bottles contain a minimum of 25% recycled PET (R-PET) by 2025, and that all beverage bottles contain a minimum of 30% recycled content by 2030.

The Commission will not focus on building infrastructure but rather in tightening rules and restrictions to make better use of current infrastructure, Ciobanu-Dordea said during the question and answer (Q&A) session of his presentation.

“We will create the conditions through more detailed harmonisation for the member states … Probably some technology innovations will be necessary, but we are not betting necessarily on building up more infrastructure, scaling up significantly the infrastructure, but using more effectively the infrastructure that exists currently,” he said.

“[With rules that are] more precise and detailed, but sometime also they will be perceived as more restrictive.”

Shortages of sufficient collection and sorting capacity to meet demand for ambitious sustainability targets – particularly from the packaging sector – are regularly cited by market players as the biggest bottleneck for recycled polymers.

Feedstock waste bale availability is currently limited across all three of the major recycled polymers: R-PET, recycled polyethylene (R-PE), and recycled polypropylene (R-PP).

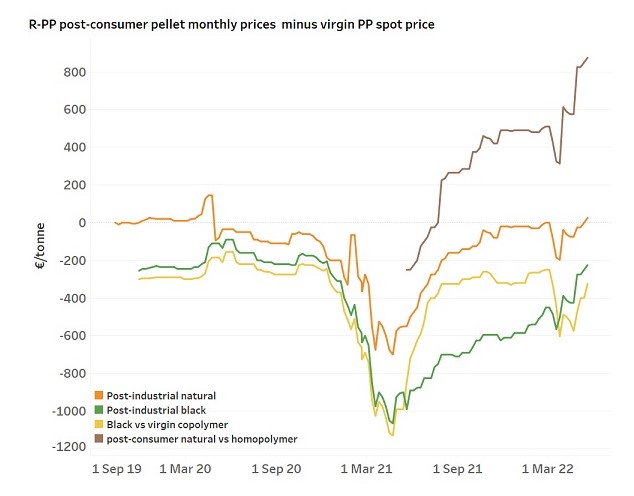

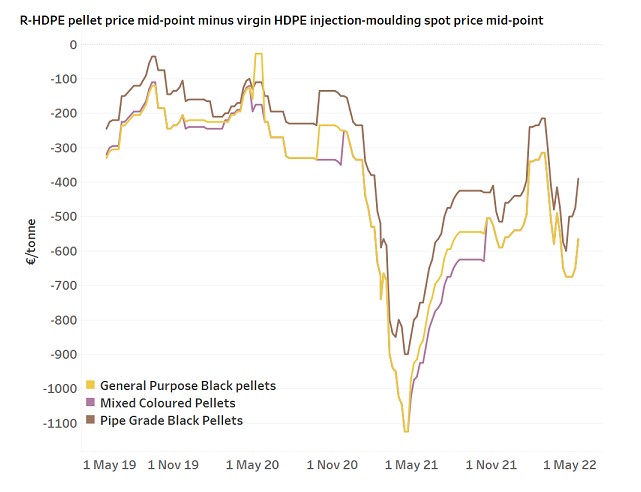

Along with energy and transport costs, shortages and high prices of waste bales have driven recycled polyolefin values to record highs in Europe.

This has led to a growing disconnect between virgin and recycled polyolefin prices, a disconnect which has existed in the R-PET food-grade pellet market for more than a decade.

“In the presentation, the EU commission highlighted the key failure in recycling is the fragmentation of collection practices and infrastructure, highlighting any actions that drive harmonisation in the recycling sector can only aid the progress in plastics circularity,” said Helen McGeough, Senior Analyst for Plastic Recycling at ICIS.

“With the ICIS Mechanical Recycling Supply Tracker recording output of total R-PET, R-PP and R-PE in Europe running at 58% of installed capacity, improved feedstock quantities and qualities are essential to not only improve the efficiency of existing recycling but drive investment for new capacities,” she added.

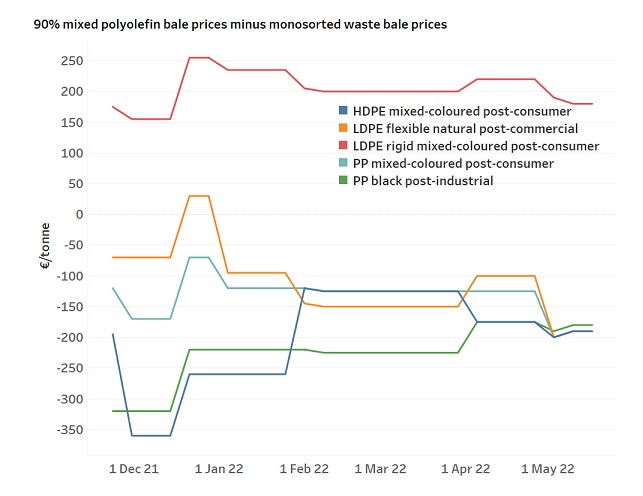

Waste bale shortages and high prices of recycled polymer flakes and pellets have led waste managers and recyclers to explore the use of mixed plastic waste to make up shortfalls, particularly for non-packaging applications such as construction.

Many non-packaging applications can handle lower quality grades than packaging, and are widening the types of grades they use as the packaging sector increasingly captures share of mono-material grades.

Historically due to higher wastage loss than monosorted material, and the higher difficulty/cost of sorting mixed plastic waste, using mixed plastic waste (particularly mixed polyolefins) was not previously economically viable, but this has now changed.

As a result, more and more waste managers have been using mixed polyolefin grades captively, and sorting material, leaving less available on the merchant market.

As chemical recycling capacity scales, mixed plastic waste is expected to further tighten, as the pyrolysis process – the dominant form of chemical recycling in Europe – typically uses mixed plastic waste grades as feedstock.

Despite not planning to significantly scale current infrastructure, the European Commission is considering mandating all EU countries to introduce deposit return schemes (DRS).

Under DRS systems, buyers pay a deposit on their packaging at the point of collection. The buyers later drops off the packaging at a deposit return point – where it is typically sorted at the point of entry into the system – and are then given their deposit back.

The advantages of DRS systems are that they typically result in higher collection rates, because they incentivise the consumer, and typically result in lower contamination because material is typically sorted at point of entry.

Nevertheless, DRS systems rely on the deposit fee being high enough to incentivise the customer and have the potential to disrupt well-functioning kerbside collection schemes, and in which some countries and companies have invested heavily.

Source : https://www.adsalecprj.com/en/news_show-77429.html

Edit : HANDLER